Introduction

Carbon markets are thought to be one of many innovative, market-based solutions to global climate change. These markets allow for the purchase of carbon “credits” by carbon emitters who need to offset their emissions based on a government set “cap”. The emitter could reduce carbon emissions or purchase credit(s) from a seller who is taking some action to reduce carbon emissions or sequester carbon. Forests are great at sequestering carbon from carbon dioxide, a primary greenhouse gas. Consequently, forest owners may qualify as sellers of carbon credits — a tradable permit that provides monetary value for sequestered carbon. This fact sheet explains some of the nuances of these emerging carbon markets and potential income opportunities available to forest landowners. It also provides an example of what a carbon project might look like for a landowner.

History& Background

The Kyoto Protocol of 1997 imposed carbon emissions limits on its signatories. This meant that carbon-emitting enterprises in signatory nations were obligated to either remain within its emissions limits or purchase carbon credits from the European carbon market. Because the United States did not sign the Kyoto Protocol, it could not participate in the European market, so a voluntary carbon credit trading market was established. In 2003, the Chicago Climate Exchange (CCX) set up a working carbon credit trading market for U.S.-based emitters. Because this market is voluntary, demand for credits is lower than in European markets, creating a disparity in carbon credit prices. In Europe, the June 2008 price of a credit representing one metric ton of carbon dioxide is approximately $40.001, while in the U.S., the June 2008 price is approximately $6.001. As voluntary participation increases and/or U.S. emissions controls are tightened, demand for credits in the U.S. will increase resulting in an expected closing of this price gap between U.S. and European markets. Furthermore, it is possible in the future the U.S. will mandate participation in a carbon credit trading scheme.

The Role of Forests

When a manufacturer or producer exceeds its emissions limit, it must purchase credits from either another entity that is below its limit, or from a carbon sequestration project, such as a forest, that results in a net reduction of atmospheric carbon dioxide. Forests are well-known for their ability to absorb or sequester carbon. As a forest grows, it accumulates biomass. This biomass is mostly in the form of trunks and branches that grow incrementally larger each year, using atmospheric carbon in photosynthesis. A rapidly growing young forest has a large yearly incremental increase in biomass and thus has a large capacity to sequester, or absorb, carbon from the atmosphere2. This ability to absorb carbon is what makes forests an important source of credits from sequestration projects. Carbon credits can also be generated when carbon-neutral fuels are substituted for fossil fuels. One such example is substituting coal with forest biomass in electricity generation. This source of credits creates an additional income to landowners for harvest residues and other forest biomass that are used for energy production.

How it Works

Carbon trading in the U.S. is conducted by the CCX which is the largest open market for carbon trading in the U.S. Membership is voluntary but legally binding. A forest landowner can sell carbon credits via the market to net emitters. Credits sold by such a landowner are called “offsets” because they offset the carbon emissions by a net emitter. The price of offsets is determined by the market, i.e. the laws of supply and demand.

Eligibility

There are four types of forests that are eligible to sell offsets as carbon sequestration projects: afforestation (establishing forest where there had not been one previously), reforestation, managed forests, and forest conservation3. Afforestation and reforestation are the clearest and most recognized ways a forest can sequester carbon. In addition to growing a new forest, proper management of an existing forest may be eligible as a carbon offset program. While it can be argued that a mature, properly managed forest is carbon neutral in the long-term, U.S. carbon markets are concerned with carbon storage over the contract period that is usually 2 to 14 years. So long as net carbon increases each year of the contract, the forest landowner earns credits that can be either “banked” or sold on the open market. For afforestation and reforestation projects, the land must have been either non-forest or degraded forest on January 1, 1990, which is the baseline date used by the CCX. To qualify as a project, tree plantings or natural regeneration must have taken place on the land since that date. A “degraded forest” is essentially one that is growing and accumulating biomass after some sort of disturbance, typically a past harvest or other land use activity, occurring prior to January 1, 1990. Examples of eligible forests include most types of commercial forests such as mid-rotation plantations that have been harvested in the past, forests recovering from natural events such as fires or hurricanes, or simple regrowth on former agricultural lands. The minimum tree density required is 250 trees per acre. Other forest land may qualify so as long as it meets the basic eligibility criteria above3.

How to Sell Carbon Credits

Credits are sold in large bundles, therefore the CCX requires small landowners to work through what is known as an aggregator. The aggregator, who pools carbon supplied from small producers/landowners, is knowledgeable in contract and documentation requirements and will assist the landowner during enrollment. An aggregator is required for any projects sequestering less than 12,500 metric tons CO2 per year4. This is equivalent to a typical southern pine forest parcel of about 2,000 acres5. In addition, third party verification is required.

To qualify, the landowner is required to demonstrate intent to keep the land in trees and continue carbon-accumulating management practices for the term of the contract. Normally this requirement is satisfied by a letter of intent submitted with the enrollment documentation. Each year, the landowner submits a report to the aggregator showing continued compliance with the initial contract. Then, semi-annually, annually, or at the end of the contract period, depending on the terms, the aggregator pays the landowner the proceeds of any carbon credits earned by the project.

Example Project

Below is an example carbon project. It should be noted that this illustration is for example purposes only. Please note that carbon trading in the United States is an evolving business and terms can change rapidly. Each project would be subject to the terms and conditions of the specific contract signed for that project.

Mrs. Johnson is a landowner in Southeast Texas. She receives a solicitation in the mail from a local associate aggregator stating interest in enrolling Mrs. Johnson in a Forestry Carbon Offset Program. Details of the letter clearly state:

•The type, age and density of your forest determines the number of carbon credits owned,

•The aggregator has been approved to identify those in your area who qualify,

•The landowner must agree to keep 250 trees per acre until 2011, and

•Type of timberland that qualifies at present time is land that was open before January 1, 1990.

The aggregator will be using the Forestry Contract provided by the Iowa Farm Bureau (IFB) Carbon Credit Program. Additional important points to note as set out by IFB contract include:

•Exchange offset are issued based on tonnage realized during the years 2003 through 2010,

•Commitments and obligation of the landowner terminate on January 1, 2011.

•If landowner fails to meet terms of the contract, payments made to the landowner shall be repaid to CCX and is subject to interest and penalties.

•CCX makes no warranty as to the marketability or market value of landowners carbon credits

•Landowners must agree to provide access to a CCX representative to conduct on-site inspection.

•In the case of willful noncompliance, the owner shall pay a penalty equal to 20% of total credit value to the aggregator as well as any costs incurred by aggregator in enforcing the contract.

•Project owners will be responsible for replacing the losses to forestry offset projects where possible, but it is unclear as to how the landowner shall do this.

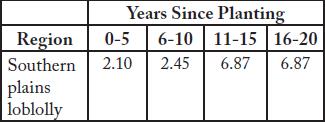

Mrs. Johnson has 42 acres that was an abandoned field prior to 1989. In February 1996, she planted all 42 acres in loblolly pine at 700 trees per acre. Today, there are 600+ trees per acre. Since this is a small tract, Mrs. Newberry must work with an associate aggregator who uses the “Dense Planting Forestation Project Carbon Accumulation Table”, the look-up table provided by the program to determine the metric tons of CO2 per acre per year potential of her 42 acres (Table 1). Credit accumulates retroactively from the year 2003. As a result, Mrs. Newberry must determine the age of the stand in 2003 (7 years old) to correctly determine the coefficient (2.45) in the look-up table (Table 1). These values are entered on line 1 in Table 2. Total Tons for the stand (1d, Table 2) is calculated by multiplying 2.45 by 42 to get 102.9 total tons (credits) for Mrs. Newberry’s 42 acres. If the credits sell on CCXat $4 per credit, total gross value for the year 2003 equals $411.6 (1e, Table 2). This process is repeated each year through 2010. Notice that in 2007 (row 5, Table 2), the coefficient jumps to 6.87 because the stand’s age (11 years) now qualifies it for a higher-value bracket on the look-up table (Table 1).

Table 1. Dense planting forestation project carbon accumulation table for Southern plains loblolly depicting the carbon coefficients by years since planting (taken from IFB’s Carbon Credit Program Forestry Contract).

Table 2. Carbon Credit Worksheet for Mrs. Newberry’s 42-acre pine plantation. (values may be rounded down to the nearest whole number by the associate aggregator)

Working through the annual calculation, Mrs. Johnson’s total carbon credits calculate to 1,566 metric tons of CO2. If the credit value is assumed to be $4.00 per ton for each year, the gross value is $6,264. Understand that the dollar value of the credits is determined by the value of the credits on CCX at the time the credits are sold on CCX. It may be greater than $4.00 per credit or it may be lower. If credits sell, landowners may be paid annually or at the time the contract expires.

Line 10 shows the Forest Carbon Reserve Pool. A quantity equal to 20% of the total gross value is held (set aside) by IFB in the event that the landowner experience an uncontrolled net loss of stored carbon during the 2003 – 2010 period due to events such as pipeline right-away. If no loss occurs then all of the 20% is returned to the project owner (landowner) at the end of the contract period as illustrated in line 15 on Table 2. Line 11 and 12 reflects the 10% service fee retained by Iowa Farm Bureau and the 10% service fee paid to the associate aggregator, respectively. The verification fee in line 13 is paid to a third-party entity that must annually inspect at least 10% of the pooled carbon offset projects for compliance. This is an estimated cost. CCX also requires an exchange fee (line 14). So the total amount due to Mrs. Johnson if paid before the end of the contract is $3,303.76 (line 15). If no loss occurs, the reserve pool is reimbursed to the landowner (line 16) after the contract has ended and the total dollar amount awarded Mrs. Johnson at that time is $4,556.37 (line 17).

The above example was adapted from the “Carbon Credits for Landowners6” fact sheet published by Texas AgriLife Extension Service and the Southern Regional Extension Forester.

Another Alternative: The Potential for a Carbon Offset Market

Another way carbon credits may benefit forest landowners is by creating a market for harvest residues and other forest biomass that would otherwise be unmarketable. The CCX creates carbon credit not only for directly sequestered carbon, but also for offset of carbon emissions from burning fossil fuels. For instance, if a power plant substitutes logging residues for a certain percentage of its fossil fuel source, the resultant reduction in net CO2 emissions can be counted as a credit to the power plant.

The Intergovernmental Panel on Climate Change (IPCC) has provided the basic framework adopted by the CCX for awarding credits based on fuel substitution7. Under this framework, a power plant earns carbon credits for substituting carbon neutral fuels for fossil fuels, typically coal. Woody biomass is considered to be a carbon-neutral fuel that is eligible for credit under this framework.

While power plants have not yet begun to utilize harvesting residues on a large scale, the trends in changing economic fundamentals suggest this is very likely in the near future as coal prices continue to escalate. At the time of this writing, coal fuel prices have increased to a point where logging residue generated electricity is nearing cost competitiveness with conventional coal generated electricity. Additional cost advantages can be gained by power generating companies when they sell carbon credits earned on the basis of fuel substitution. At current carbon credit prices ($7.00 per metric ton of CO2), the potential value of using the recoverable logging harvest residue available in Texas, for example, is estimated at $14.4 million8. There is an opportunity here for revenue sharing between the power generating facility and the landowner providing harvest residues and other forest biomass. Yet, such a mechanism is yet to be developed.

Conclusion

Although a carbon market in the U.S. has been established, it remains in its infancy. There are still many unknowns. Forest landowners should be able to benefit from the increased interest in carbon trading either through direct sequestration or revenue sharing with power generation facilities. Yet, the decision to participate in carbon market programs will undoubtedly be heavily influenced by factors such as commitment period, associated fees, market access, inventory needs, and silvicultural treatments. This decision should be made only after careful consideration or consultation with professionals experienced in this subject matter area.

Endnotes

1 Chicago Climate Exchange, www.chicagoclimatex.com, Accessed May 19, 2008.

2 Birdsey, R.A. 1996. Regional Estimates of Timber Volume and Forest Carbon for Fully Stocked Timberland. In. Forests and Global Change: Vol. 2, Forest Management Opportunities for Mitigating Carbon Emissions, R.N. Sampson and D. Hair (eds.) pp. 309-334, American Forests, Washington, DC.

3 Ruddell, S., M.J. Walsh, and MKanakasabai. 2006. Forest Carbon Trading and Marketing in the United States. North Carolina Division of the Society of American Foresters (SAF)

4 North Dakota Farmers Union. 2008. 2003-2012 Application for Participation in a Forestry Off Set Pool and Sales Contract for Exchange Forestry Off Sets (XFOs): CCXEligibility Requirements. http://carboncredit.ndfu.org/4dlink/4dcgi/certreport/Sample/Forestry Accessed May 21, 2008.

5 Miller, D.A. 2007. Forestry Offsets from Tree Plantings & Reforestations. Iowa Farm Bureau, Carbon Credit Program. <http://www.iowafarmbureau.com/special/carbon>

6 Taylor, E.L., Caraway, B., and Foster, C.D. 2007. Carbon Credits for Landowners. Texas AgriLife Extension Service Publication 805-138. Also published as Southern Regional Extension Forestry Publication SREF-FM-012. http://sref.info/publications/online_pubs/publications/online_pubs/carbo…

7 Intergovernmental Panel on Climate Change, www.ipcc.ch, Accessed May 19, 2008

8 Gan, J. and C.T. Smith. 2007. Co-benefits of utilizing logging residues for bioenergy production: the case for East Texas, USA. Biomass and Bioenergy. 31: 623-630.